- 8 months ago

- 4Minutes

- 679Words

- 18Views

In today’s fast-paced world, managing your finances efficiently is more important than ever, especially in the United States. Whether you’re saving for a big purchase, building an emergency fund, or simply trying to make your paycheck stretch a little further, cutting nonessential expenses is a smart way to achieve your financial goals. Here are five savvy strategies to help you trim the fat from your budget and keep more money in your pocket:

1.Create a Budget and Stick to It

The first step in trimming nonessential expenses is knowing exactly where your money is going each month. Take some time to sit down and create a budget that outlines your income, fixed expenses (like rent or mortgage payments), and variable expenses (such as groceries, dining out, and entertainment). Once you have a clear picture of your financial situation, identify areas where you can cut back and set realistic spending limits for each category. Then, commit to sticking to your budget to avoid overspending and ensure that your money is working for you.

2. Cut Out Unnecessary Subscriptions and Memberships

In today’s subscription-heavy world, it’s easy to accumulate a slew of recurring charges for services you may not even use, especially in the United States. Take a close look at your monthly subscriptions and memberships, from streaming services and gym memberships to magazine subscriptions and meal delivery kits. Are you really getting value from each of these expenses, or are they just draining your bank account? Consider canceling any subscriptions or memberships that you don’t actively use or that no longer bring you joy. You’ll be surprised how much you can save each month by trimming the fat in this area.

3. Shop Smarter and Comparison-Shop

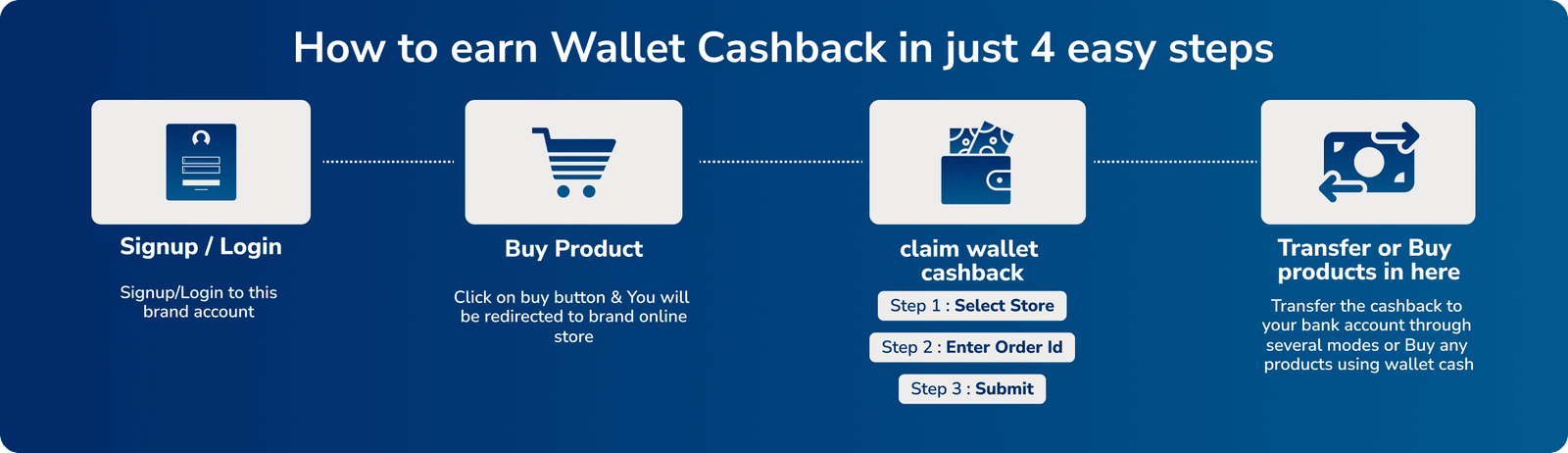

When it comes to everyday expenses like groceries, clothing, and household goods, a little bit of strategic shopping can go a long way, especially in the United States. Take the time to comparison-shop and look for deals and discounts before making a purchase. Clip coupons, sign up for loyalty programs, and take advantage of cashback offers to stretch your dollars further from platforms like CommissionKart. Additionally, consider buying generic or store-brand products instead of name brands to save even more money without sacrificing quality. By being a savvy shopper, you can significantly reduce your expenses and keep more money in your wallet.

4. Cook at Home and Meal Prep

Eating out can be convenient, but it’s also one of the quickest ways to blow your budget, particularly in the United States. Instead of dining out multiple times a week, make an effort to cook at home and meal prep whenever possible. Not only is cooking at home more affordable, but it’s also healthier and allows you to have greater control over the ingredients you consume. Plan your meals for the week ahead, make a grocery list, and stick to it when you go shopping to avoid impulse purchases. By preparing meals at home, you can save a significant amount of money over time and still enjoy delicious and satisfying meals.

5. Automate Your Savings

One of the easiest ways to trim nonessential expenses is to automate your savings, a strategy widely used in the United States. Set up automatic transfers from your checking account to your savings account each month to ensure that you’re consistently setting aside money for your financial goals. Treat your savings like a recurring bill and prioritize it just like you would any other expense. By paying yourself first, you’ll build a solid financial foundation and have peace of mind knowing that you’re making progress toward your goals, even when life gets busy.

Conclusion

In conclusion, trimming nonessential expenses is a key component of smart financial management, especially for individuals in the United States. By creating a budget, cutting out unnecessary subscriptions, shopping smarter, cooking at home, and automating your savings, you can free up more money in your budget and work toward achieving your financial goals. Remember, every dollar saved is a dollar earned, so take control of your finances today and start building a brighter financial future for yourself and your family.